Only one percent of the audit opinions issued by Audit firms on “alternative investment funds” contained a qualified opinion. With the amount of regulatory scrutiny of alternative fund Managers and the important role played by Audit firms, Convergence undertook a review of the Managers and their funds subjected to a qualified opinion and the Audit firms who issue them.

A qualified opinion is a written statement by a certified public accountant in an audit report, stating that the financial statements of a client are fairly presented, except for a specified issue. The issue typically relates to a limitation on the scope of the audit, so that the auditor was unable to obtain sufficient evidence to verify various aspects of the transactions and reports being audited. Qualified opinions may also be issued if there is a lack of conformity with GAAP, inadequate disclosure, uncertainties in estimates, or the statement of cash flows has been omitted. In essence, an organization that is being audited tries to avoid a qualified opinion, since it casts doubt on the financial statements of the entity. Institutional Fund Investors view a qualified opinion as a serious red flag that can suggest broader control issues across a Manager’s organization.

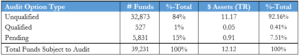

Convergence tracks information on qualified and unqualified fund audits and audits pending for 8,000 + Advisors and their 51,000 funds. Of these 51,000 funds, 39,231 are subject to an audit. Of these 39,231 funds, 32,873 (84%) received unqualified audit opinions, 527 (1%) received a qualified audit opinion, and 5,831 (15%) are pending. Although qualified audit opinions represent only 1% of the population, they account for over $50 billion in assets. Funds with audits pending represent $906 billion in assets.

Table 1: Distribution of Audit Opinions across all Alternative Funds

We examined the 527 qualified audit opinions to shed some light on the Managers who received them and the Audit firms issuing them to answer the following three questions:

- Does the Size of the Fund Manager Matter?

- Is there a relationship between the size of a manager and the likelihood that one or more of their funds will receive a qualified audit opinion? Conventional wisdom suggests larger managers can afford the control infrastructure needed to receive unqualified audit opinions.

- Does the Selection of an Audit firm matter?

- Do Audit firms issue qualified audit opinions in equal proportion to their share of the fund audit market? For example, does an Auditor with a 10% share all funds issue 10% of all qualified audit opinions? All things remaining equal they should.

- Are there any consequences to Audit firms issuing more qualified audit opinions?

- Do Audit firms that issue more qualified audit opinions grow at the same rates as others who issue less? To conduct our research we examined the top 8 Audit firms based on the number of funds they Audit. This group audits 86% of all private funds and issued 66% of all qualified opinions.

Our research on qualified audit opinions revealed the following:

- MANAGER SIZE DOES MATTER!

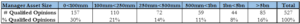

- The funds Advised by Managers having less than 1bn in firm-wide assets receive 3 times as many qualified audit opinions than larger Managers (see Table 2).

- AUDITOR SELECTION MATTERS!

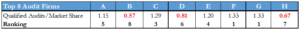

- Audit firms DO NOT issue qualified opinions equal to their share of the market!

- 3 of the top 8 Auditors issued materially fewer qualified audits than their other 5 peers (see Table 3).

- THERE ARE CONSEQUENCES TO ISSUING MORE QUALFIED OPINIONS!

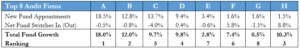

- Audit firms issuing more qualified opinions grow slower than their peers

Table 2: Distribution of Qualified Audits based on Manager Size

Data shows that Managers with <1bn in assets receive 76% of all qualified audit opinions.

Table 3: Ratio of Share of Qualified Opinions to Market Share

Data shows that 3 of 8 auditors do not issue qualified audit opinions in equal proportion to their share of the alternative fund market. These are highlighted in red in the data table.

Table 4: Share of New Fund Audit Appointments and Switches-In

Data shows growth rates and ranking for top 8 Audit firms during prior 3 years. Firm C, E, F & G grow slower than firms A, B, D and H.

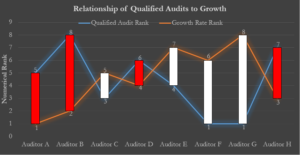

Table 4a: Growth Rankings and Qualified Audit Rankings

Data shows an inverse relationship between rank of Growth & Qualified Audit Opinions for the top 8 Audit firms.

Table 4b. Graph of Relationship between Qualified Audit and Growth Rankings

Data shows significant divergence between Auditors who issue more than their fair share of qualified audit opinions. Pay particular attention to Auditors F&G, who share the #1 rank in number of qualified opinions issued versus their share of the fund audit market. These two Audit firms win materially less business than their peers, ranking 6th and 8th, respectively. Is it possible that this statistic, regardless of the reason driving it, simply makes it harder for them to win their fair share of new business? After all, who wants to deal with an Audit firm that may appear to be the toughest on the block?

Summary

The funds advised by alternative asset Managers with less than 1bn in AUM are 3 times more likely to receive a qualified audit opinion than Managers with greater than 1bn. Audit firms issuing more qualified audit opinions than their peers grow more slowly than peers who issue fewer qualified audit opinions. In fact, the growth rates for these Auditors are inversely correlated to their share of qualified opinions issued. The reasons for this divergence can be explained by a number of business factors, including the size of the Auditor’s clients, the Complexity/Risk Profile© of the Managers and fund audits conducted and the Auditor’s client selection process. Convergence encourages the use of this type of data when evaluating Auditors in this very competitive market.

For more information on Convergence, this report and our analytical and research products please go to our website at www.convergenceinc.com or call John Phinney @ 203-956-4824 or George Evans @ 215-704-7100.