This post, written by Convergence’s John Phinney and George Evans, was originally posted on GARP – Global Association of Risk Professionals on March 10, 2017.

Massive amounts of siloed and unstructured data complicate the huge challenge of managing operational risk in the rapidly growing alternative assets industry. However, advanced data analysis can temper this risk by uncovering the impact of operating model decisions and by detecting complex patterns that are not otherwise readily transparent.

Last year, in a feat that was thought to be impossible not too long ago, an artificial intelligence program created by Google beat an established master at the Chinese board game “Go” for the first time. The program, AlphaGo, did so in part by recognizing and taking advantage of complex patterns in the movement of the stones used by the game’s players — patterns that were invisible to its human competitor.

Something similar is happening with efforts to manage operational risk in the alternative asset management industry, which includes hedge funds, private equity, real estate and structured assets. With more than 17,000 registered investment advisors, 58,000 alternative funds and an expected $20 trillion in assets by year-end 2020, the industry is vastly complicated. Moreover, a massive and expanding publicly-accessible digital footprint comprised of ADV filings, vendor relationships and RFPs adds to its complexity.

Indeed, in 2016, alternative asset managers filed 40,000 ADVs — and, what’s more, 40% filed more than once (up 28% from 2015). Historically, this data has been mostly siloed and unstructured. Now, however, newer technologies are emerging that can capture this information in a normalized, structured database.

The Data Analysis Payoff

While the data flow can be massive (as much as a terabyte a day), the payoff from providing daily analysis can be significant. As with artificial intelligence and Go, patterns start to emerge that were previously undiscoverable. The data algorithms typically look for change at the margin among factors that include internal valuation, self-administration and qualified audits, for example.

The working thesis behind the expanding use of advanced data analysis is straightforward: complex systems can add risk, and unnecessarily complex systems can add unnecessary risk. A corollary would be that, as an investor or allocator, you want to know that a manager has systems in place that are commensurate with the level of operational risk inherent in the fund.

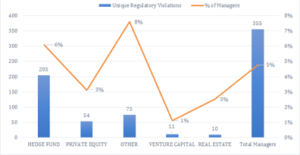

While many of the operational changes flagged by data analysis may not seem especially worrying in isolation, patterns that emerge through such analysis may suggest otherwise. Detection of complex patterns could have, for example, come in handy for the eight percent of alternative asset advisors that incurred a regulatory violation over a recent 36-month period (see Figure 1, below).

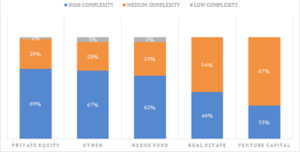

Prior to their regulatory issues surfacing, 80 percent of the regulatory “violators” had a medium or high complexity profile. Of course, provided that systems are in place to manage it properly, a high level of complexity (see Figure 2, below) isn’t an issue in and of itself. Moreover, the patterns discerned by the algorithms are worth knowing, regardless of whether or not they portend a regulatory issue.

In the case of the alternative asset managers that incurred a regulatory violation, identifying these patterns may or may not have saved the day — but it would have at least suggested that a closer look under the hood was in order. These kinds of operational metrics may have been largely invisible in the traditional due diligence process.

Human beings are geared to detect patterns, but can be quickly overwhelmed by the kinds of massive data now available in the alternative assets space. Fortunately, technology has reached the point where high volume and multiple sources are no longer insurmountable obstacles.

In fact, the measurement of operational risk can now provide significant insight across the entire industry, from allocators to the managers themselves. Like AlphaGo, it’s just a matter of seeing what’s in front of our eyes in new ways.

John Phinney and George Evans are co-founders of South Norwalk, CT-based Convergence Inc., which identifies, tracks and reports changes across the alternative asset management industry on a daily basis.

![Single Post [Template] Single Post [Template]](https://www.convergenceinc.com/wp-content/uploads/2019/09/sean-pollock-PhYq704ffdA-unsplash-1.png)