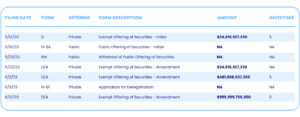

Convergence wishes to highlight the remarkable regulatory filing footprint created by Lowe Equity Partners, located at 5051 Peachtree Corners Circle, Suite 200 Peachtree Corners, Georgia 30092.

Convergence called Mr. Emory L. Lowe, the President/CEO of Lowe Equity Partners for comment. Mr. Lowe declined to provide us with color on this enormous accomplishment, other than to say, “It is not an error.” While we do not doubt Mr. Lowe, we are pretty certain that his filings contain errors.

Convergence calls firms when we identify “data anomalies” within and across their various regulatory filings. We attempt to seek confirmation before using the data in our analytics. Please respond if we call you so that we validate these numbers because we do publish them. We have pointed out many such data issues to advisers who have quickly filed a correcting amendment to avoid embarrassing errors and keep our data clean from such anomalies. While Mr. Lowe represented that the data in his Form D filings are correct, we removed it from our databases for the following reasons:

- The reported amount sold of $999,999,975,000 would be the largest hedge fund in the history of hedge fund offerings!

- Lowe Equity Partners will become 20 times bigger than the world’s largest hedge funds run by Millenium, Citadel, and Bridgewater!

- The amount and pacing of the incremental capital raised set a record for fundraising and he did not disclose paying a selling or broker commission to raise it!

- We were unable to verify and validate Mr. Lowe and Lowe Equity Partners’ expertise in raising capital and/or running a hedge fund of this size.

Moral of the Story

We encourage investors, service providers, investment advisers, and regulators to speak with us and learn about how they can benefit from the way that we leverage our unique combination of technology, data science, and subject matter experts to study, interpret and tell stories based on regulatory filings. Please contact John Phinney for more information or Request a Demo.

![Single Post [Template] Single Post [Template]](https://www.convergenceinc.com/wp-content/uploads/2019/09/sean-pollock-PhYq704ffdA-unsplash-1.png)