The investment Advisory firms Raymond James and Robert W. Baird settled charges last week with the SEC regarding compliance failures with their wrap fee programs. The SEC alleges that these Advisors, who collectively manage over $269 billion in regulatory assets and $1.2 billion in private assets, failed to produce policies that would allow them to value commissions charged to clients when sub-advisors used the services of broker-dealers not included in the wrap fee program. Without this information, the SEC alleges that they failed to uphold their fiduciary duty to select appropriate sub-advisors and wrap fee programs for clients. They also claimed that “certain clients” weren’t aware that they were paying additional costs outside of the agreed wrap fee bundle. Without admitting or denying the charges, Raymond James paid $600,000 and Baird paid $250,000 in penalties.

With this action, the SEC is continuing to heighten regulatory enforcement against Registered Investment Advisors in an effort to increase transparency and disclosure around fees and compensation. Earlier this month, Apollo Global Management and WL Ross both disclosed SEC regulatory actions resulting in investor reimbursements and related fines due to fee disclosure violations. Based on the recent surge in all types of regulatory violations (21 violations reported in Q3 thus far), regulators are clearly casting a wider net when reviewing an Advisory firm’s disclosure policies. According to the SEC, “The SEC’s National Exam Program has included wrap fee programs among its annual examination priorities, particularly assessing whether advisers are fulfilling fiduciary and contractual obligations to clients and properly managing such aspects as disclosures, conflicts of interest, best execution, and trading away from the sponsor broker-dealer,” (Press Release).

In Convergence’s database, there are currently 334 Unique Managers that collectively disclose 3,902 unique Wrap Fee programs and manage over $1.82 trillion in private funds. One potential concern for compliance personnel is the added complexity and work required to maintain and disclose fee information when firms have multiple wrap fee programs. At the Manager group level, Baird Group reports 24 wrap fee programs and Raymond James reports 55, putting them both above the average count of roughly 12 wrap fee programs per Manager. This requires significant oversight and personnel to make sure that their Advisors are in compliance with the wrap fee agreements.

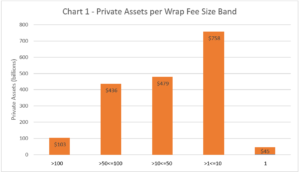

Collectively, this we see in Chart 1 that Managers with greater than 1 and less than or equal to 10 wrap fee programs manage $758 billion in private fund assets, making it the most common size band. There are 97 Managers with greater than 10 wrap fee programs that collectively manage $1 trillion in private fund assets.

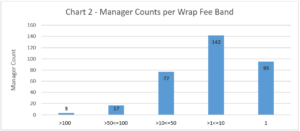

In Chart 2, you can see that Managers with greater than 1 and less than or equal to 10 wrap fee programs represent 43% of all Managers that have at least one wrap fee program. Managers with greater than 10 wrap fee programs make up 29% of this population. Based on our complexity ratings, Convergence believes that Advisors with greater than 10 unique wrap fee programs, like Raymond James and R. W. Baird, have an increased level of complexity with added risks.

Press Release: https://www.sec.gov/news/pressrelease/2016-181.html

Source:

U.S. Government. Securities and Exchange Commission. Two Firms Charged With Compliance Failures in Wrap Fee Programs. U.S. Securities and Exchange Commission. N.p., 8 Sept. 2016. Web. 8 Sept. 2016.